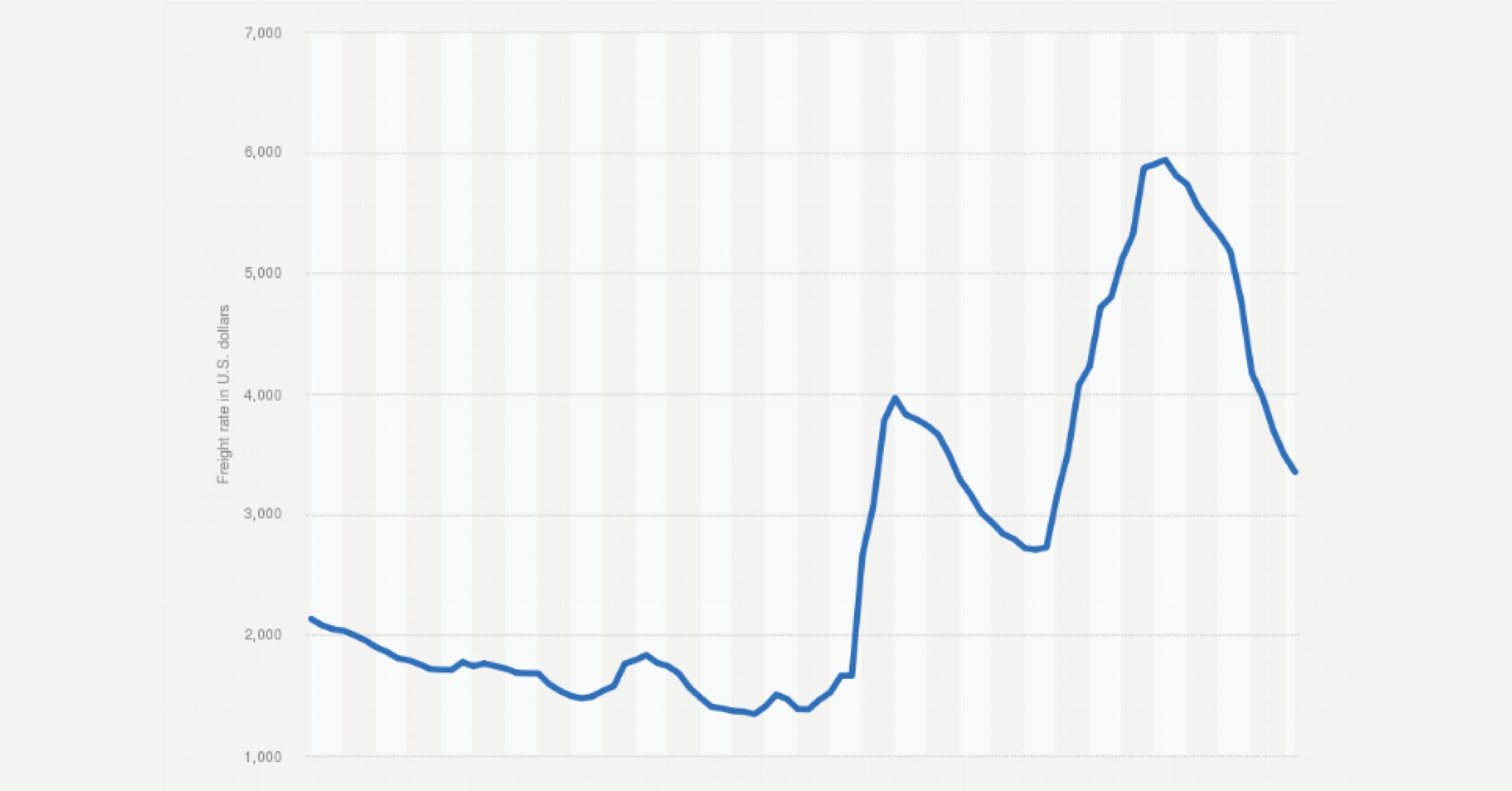

As of 2024, global container shipping rates have experienced significant fluctuations, reflecting the ongoing complexities of international trade and logistics. Following a period of unprecedented highs during the pandemic, when shipping costs skyrocketed due to supply chain disruptions, 2024 has seen a return to more stabilized, albeit varied, rates. This transition is influenced by several key factors, including demand-supply dynamics, geopolitical tensions, and environmental regulations. Container freight rates experienced significant fluctuations between January 2023 and October 2024. On October 26, 2023, rates plummeted to their lowest level, with a 40-foot container costing just $1,342. However, this downward trend was reversed, and by July 2024, rates soared to a record high of over $5,900. As of October 10, 2024, the rate had decreased to $3,349 per 40-foot container.

One of the primary drivers of the current rate environment is the balancing act between supply and demand. After a period of aggressive fleet expansion, many shipping companies have invested in new vessels, aiming to accommodate anticipated growth in global trade. However, a slowdown in consumer demand, particularly in key markets like the United States and Europe, has led to an oversupply of shipping capacity. As a result, shipping lines have found themselves in a competitive environment, leading to rate reductions to attract cargo.

Geopolitical factors have also played a crucial role in shaping container shipping rates in 2024. The ongoing tensions between major economies, trade policy shifts, and disruptions in supply chains have created uncertainty in global trade patterns. Shipping routes have had to adapt to these changes, with some lines seeking alternative pathways to mitigate risks associated with political instability. These factors have contributed to fluctuations in rates, especially for trade routes heavily impacted by geopolitical tensions.

Another significant aspect influencing the container shipping landscape is the increasing emphasis on sustainability and environmental regulations. The International Maritime Organization (IMO) has implemented stricter emissions targets, prompting shipping companies to invest in greener technologies and alternative fuels. While these investments may drive up operational costs in the short term, they also position companies for future growth as consumers and regulators demand more sustainable practices. As a result, the cost of compliance is likely to be reflected in shipping rates, further complicating the pricing landscape.

Looking ahead, the future of global container shipping rates is uncertain but could stabilize as market dynamics evolve. Analysts anticipate that demand for shipping services will continue to grow, particularly in developing markets, as e-commerce and global trade expand. However, the pace of this growth will depend on various factors, including economic recovery post-pandemic, geopolitical stability, and the effectiveness of sustainability initiatives.

In conclusion, while 2024 has seen a normalization of container shipping rates compared to the pandemic highs, the industry remains in a state of flux. Shipping companies must navigate a complex interplay of demand-supply dynamics, geopolitical influences, and environmental regulations. As the industry adapts to these challenges, stakeholders should brace for continued volatility in shipping rates but also opportunities for innovation and growth in a rapidly evolving global marketplace.

Source: Statista Research Department

(ResearchDepartment, 2024)